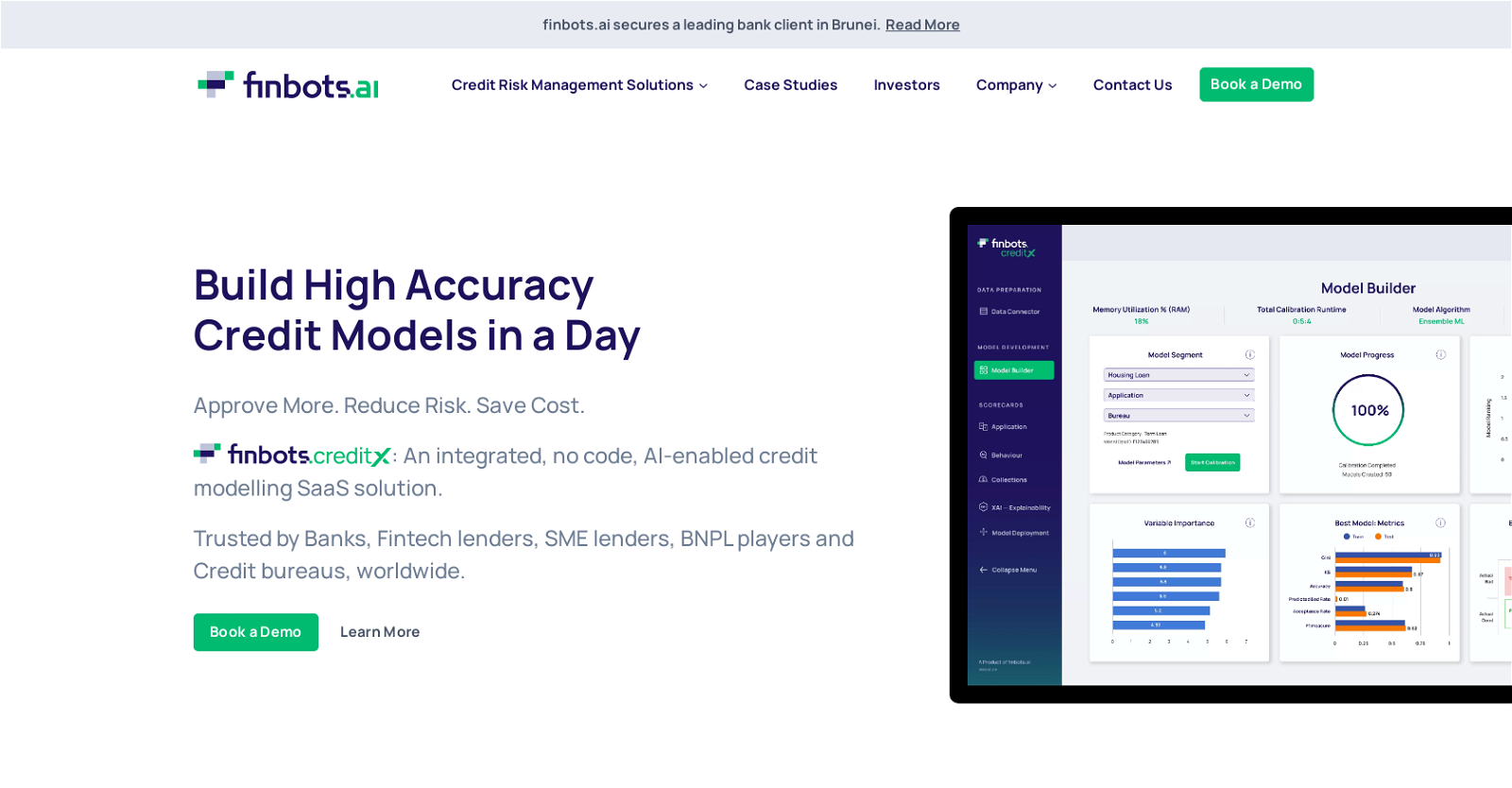

What is Finbots.ai?

Finbots.ai is an end-to-end, AI-powered credit modeling solution that aids in smarter, quicker, and more inclusive lending.

What kind of services does Finbots.ai provide?

Finbots.ai provides an integrated AI-led SaaS platform to build, validate, and deploy high-performance credit models across applications, behaviour, and collections. It offers three types of scorecards for credit risk management: application scorecards, behaviour scorecards, and collection scorecards.

How does Finbots.ai use AI in its credit modelling?

Finbots.ai uses advanced AI algorithms in its credit modelling to build, validate, and deploy sharper credit models that allow more approvals with less risk. It utilizes machine learning techniques to optimize the credit modelling process.

How can Finbots.ai help to reduce credit risk?

Finbots.ai mitigates credit risk by leveraging the power of AI to build high-accuracy credit models. It provides three types of scorecards that are designed to help detect risky clients, predict high-risk scenarios before default, and improve debt collection and recovery rates.

What are the three types of scorecards offered by Finbots.ai?

Finbots.ai offers three types of scorecards, including application scorecards, behavior scorecards, and collection scorecards.

What is the technology behind the Finbots.ai tool?

The technology behind Finbots.ai includes an AI-led SaaS platform that uses advanced AI algorithms to assist in building, validating, and deploying precise credit models across the full credit lifecycle.

How does the Finbots.ai platform ensure transparency and fairness?

The Finbots.ai platform is designed to be transparent and fair. Its AI is explainable, allowing users to see the rationale behind decisions. This ensures customers have complete control over the decisions made with the platform.

What are the five core principles that the Finbots.ai operates on?

The Finbots.ai operates on five core principles, which are accuracy, speed, transparency, adaptability, and inclusiveness.

Who are the typical clients of Finbots.ai?

The typical clients of Finbots.ai include banks, fintech lenders, SME lenders, Buy-Now-Pay-Later players, and credit bureaus.

What are some key results achieved by using Finbots.ai?

Key results achieved by using Finbots.ai include over 25% increase in approvals, 15% decrease in loss rates, and a 20-points increase in GINI.

How does Finbots.ai contribute to better and more inclusive lending practices?

By leveraging advanced AI algorithms, Finbots.ai provides more accurate predictions of creditworthiness, allowing its clients to approve more loans, thereby lending more inclusively.

How does Finbots.ai help lenders to approve more loans with less risk?

Finbots.ai helps lenders approve more loans with less risk by enabling them to construct and deploy precise credit models that employ AI-led computations to calculate credit scores, monitor borrower behavior, and manage collections effectively.

What is the process of building a credit model with Finbots.ai?

Building a credit model with Finbots.ai involves using their AI-led SaaS platform to build, validate, and deploy high-performance credit models across applications, behaviour, and collections.

How does Finbots.ai's credit modelling solution differ from its competitors?

IDK

Can Finbots.ai integrate with existing data, workflows, and systems?

Yes, Finbots.ai is adaptable and is designed to integrate perfectly with the data, workflows and systems a client already has in place.

What is the advantage of using Finbots.ai over traditional credit risk management approaches?

Finbots.ai enables faster decision-making and reduces risk through the use of advanced AI algorithms, which provide more accurate predictions of creditworthiness. In contrast to traditional approaches, it allows creation of credit models within minutes, leading to cost savings and efficiency.

How fast can Finbots.ai build and deploy a credit model?

Finbots.ai can build and deploy credit models within minutes.

Is there a demo option available for Finbots.ai?

Yes, there is a demo option available for Finbots.ai. Interested parties can book a hands-on demo to see how credit models are created within minutes.

What recognition has Finbots.ai received in the industry?

Finbots.ai has been selected by MAS as among the top 10 Fintechs in Singapore in 2022. It also placed in the top 25 for the Huawei Spark Ignite 2022 global startup competition, among other recognitions.

How can Finbots.ai help with my credit bureau business?

For credit bureaus, Finbots.ai can help improve their decision making by providing accurate and fast credit models. Finbots.ai’s innovative AI-led platform assists in creating precise credit scorecards, enabling credit bureaus to make more informed, quicker lending decisions, thereby reducing risk and increasing efficiency.